Top 5 Things That Can Affect Your Mortgage Approval

Getting a mortgage is a key step in buying a home. But not everyone gets approved. Lenders carefully check your finances before offering a loan. Here are the top 5 things that can affect your mortgage approval — and how to improve your chances.

1. Credit Score

Your credit score shows how well you manage money and pay debts.

Why it matters:

- Higher scores get better interest rates

- Low scores may lead to denial or higher loan costs

What to do:

- Aim for at least 620 (minimum for many loans)

- For the best rates, try to score 740+

- Pay bills on time and reduce credit card debt

2. Debt-to-Income Ratio (DTI)

DTI compares your monthly debt to your monthly income.

Example:

If you earn $5,000/month and spend $2,000 on debts, your DTI = 40%

Why it matters:

- Most lenders prefer DTI under 43%

- Lower DTI = less risk for lenders

What to do:

- Pay off credit cards or personal loans

- Avoid taking on new debt before applying

3. Employment and Income Stability

Lenders want to see steady income and job history.

What they look for:

- At least 2 years in the same job or field

- Proof of income (pay stubs, tax returns, bank statements)

- Reliable, verifiable income source

What to avoid:

- Job hopping or switching careers during the mortgage process

4. Down Payment Size

The more you put down, the less you need to borrow — and the safer it looks to lenders.

Typical down payments:

- 20% = no private mortgage insurance (PMI)

- FHA loans = as low as 3.5%

- VA/USDA loans = 0% (for eligible buyers)

Why it matters:

- Bigger down payments can boost your approval chances

- Smaller down payments may need stronger credit or higher income

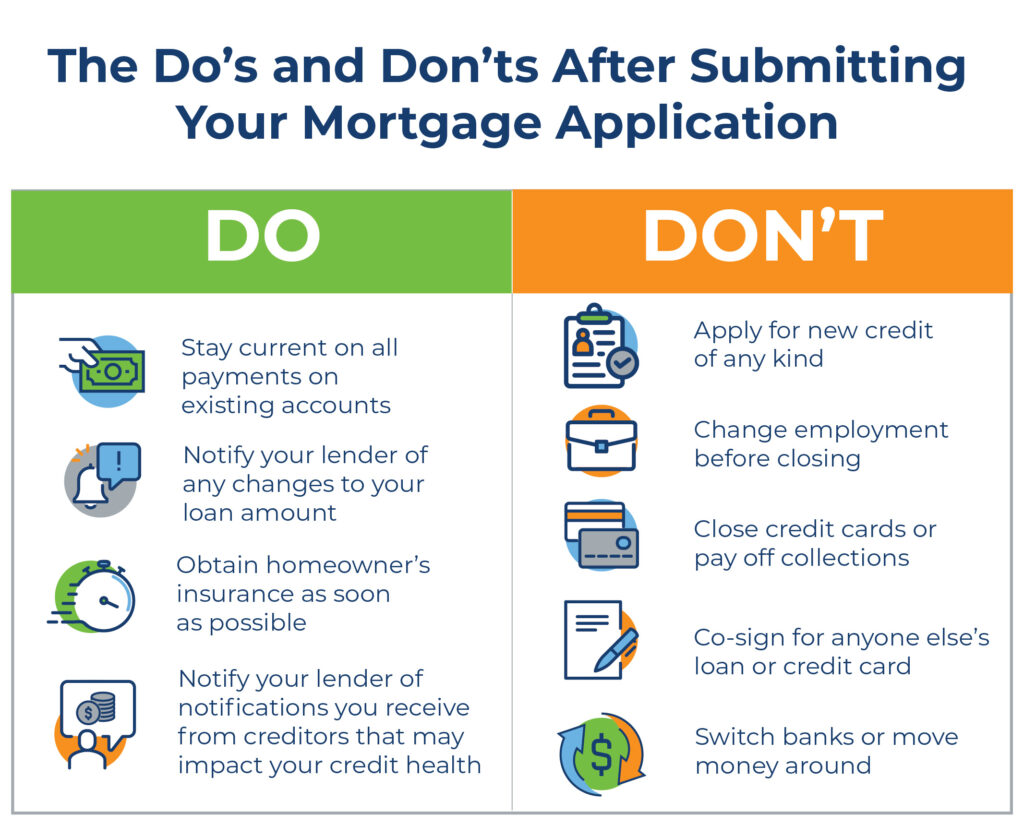

5. Recent Financial Behavior

Your actions before and during the application process matter.

What can hurt approval:

- Opening new credit cards or loans

- Large, unexplained bank deposits

- Missing payments or running up debt

What to do:

- Keep your finances steady

- Don’t make big purchases (like a car) during the process

- Avoid applying for new credit

Conclusion

Your mortgage approval depends on more than just income. Lenders look at credit, debt, job history, savings, and financial behavior. By preparing early and managing your finances wisely, you can improve your chances and get better loan terms.