Fixed vs. Adjustable-Rate Mortgage: Which One Is Right for You?

Choosing the right mortgage is a big part of buying a home. One of the most important decisions is whether to go with a fixed-rate or an adjustable-rate mortgage (ARM). Each has pros and cons, and the right one depends on your financial goals. Here’s a simple guide to help you decide.

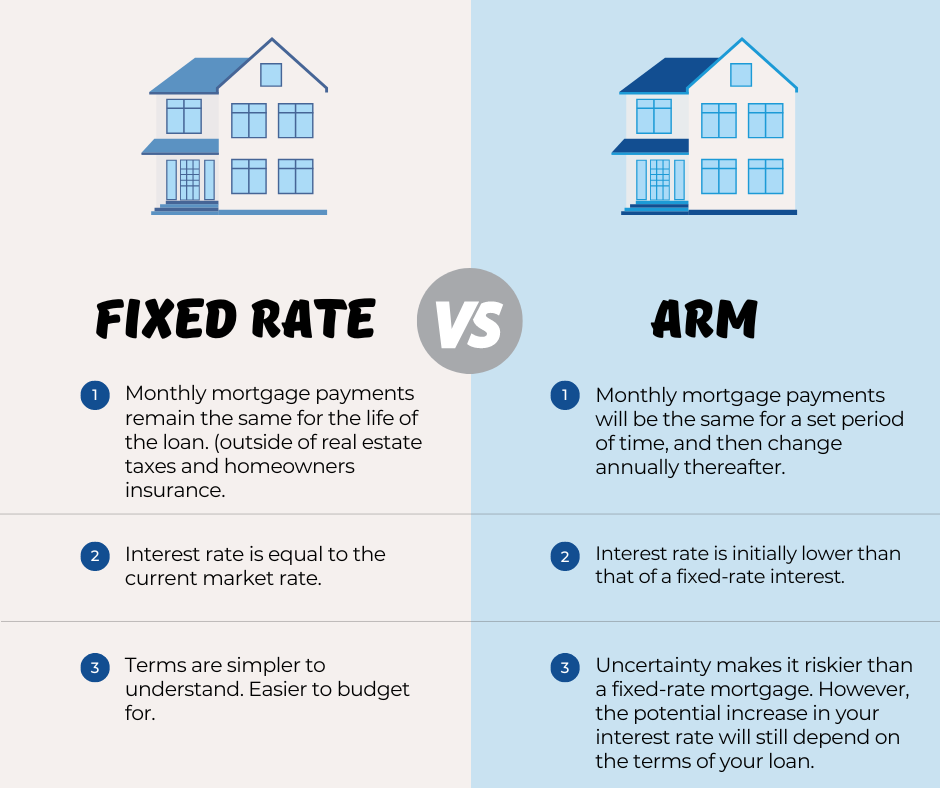

1. What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage means your interest rate and monthly payments stay the same for the entire loan term (usually 15, 20, or 30 years).

Pros:

- Predictable monthly payments

- Easier to budget long-term

- Protection from rising interest rates

Best for:

- Buyers planning to stay in their home for many years

- People who prefer stability and long-term budgeting

2. What Is an Adjustable-Rate Mortgage (ARM)?

An ARM starts with a lower interest rate for a few years (usually 3, 5, 7, or 10 years), then adjusts periodically based on market rates.

Pros:

- Lower initial interest rate

- Lower payments during the fixed period

- Can save money if you move or refinance early

Cons:

- Monthly payments can rise after the fixed period

- Harder to predict long-term costs

Best for:

- Buyers who plan to move or sell within a few years

- People expecting higher income in the future

3. Key Differences:

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Stays the same | Changes after fixed period |

| Monthly Payment | Fixed | Can increase or decrease |

| Initial Rate | Usually higher | Lower during intro period |

| Risk Level | Low | Higher after adjustment |

| Good for Long-Term Stay | Yes | Not ideal |

4. How to Choose the Right One

Ask yourself:

- How long will I stay in this home?

- Can I handle payment increases in the future?

- Do I want stable payments or lower early costs?

- Is the current interest rate low or high?

Rule of thumb:

- If you plan to stay 7+ years, a fixed-rate is safer.

- If you plan to stay less than 5 years, an ARM may save money.

Conclusion

Both fixed and adjustable-rate mortgages have their advantages. A fixed-rate offers long-term stability, while an ARM gives short-term savings. The best choice depends on your budget, timeline, and risk comfort. Before deciding, talk to a mortgage advisor and run the numbers.