First-Time Homebuyer’s Guide to Getting a Mortgage in the USA

Buying your first home is exciting — but understanding how to get a mortgage can feel overwhelming. If you’re a first-time homebuyer in the USA, this guide breaks down the mortgage process step-by-step to help you get started with confidence.

1. Understand What a Mortgage Is

A mortgage is a loan from a bank or lender to help you buy a home. You agree to pay it back monthly over time, usually with interest.

Common Mortgage Terms:

- Principal: The amount you borrow

- Interest: The cost of borrowing

- Term: The number of years to repay (e.g., 15 or 30 years)

- Monthly Payment: Includes principal, interest, taxes, and insurance (PITI)

2. Check Your Credit Score

Lenders use your credit score to decide if you qualify and what interest rate to offer.

What You Need:

- Good score: 620 or higher for most loans

- Better deals: 740+ score

Tip: Check your credit report early and fix any errors before applying.

3. Save for a Down Payment

A down payment is the amount you pay upfront. It reduces the loan size.

Common Options:

- Conventional loans: 5%–20% down

- FHA loans: As low as 3.5%

- VA/USDA loans: May offer 0% down (for eligible buyers)

Also budget for closing costs (2%–5% of the home price).

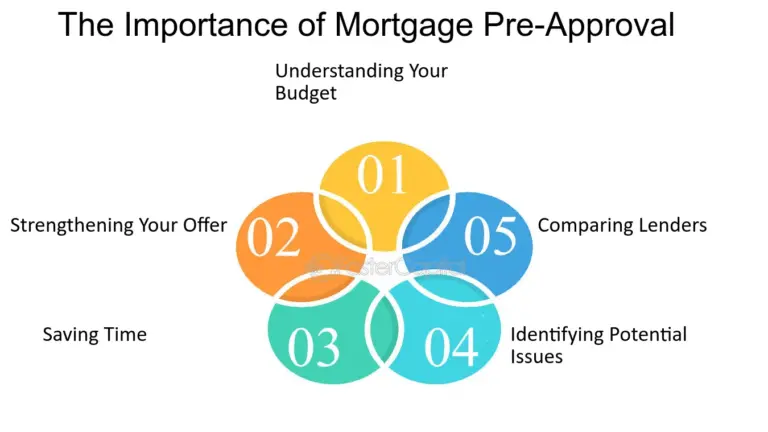

4. Get Pre-Approved for a Mortgage

Pre-approval shows sellers you’re serious and financially ready.

You’ll need to submit:

- Income and employment details

- Credit score and report

- Bank statements and tax returns

- ID and Social Security Number (SSN)

Result: You’ll receive a letter stating how much you’re approved to borrow.

5. Choose the Right Mortgage Type

Common options include:

| Mortgage Type | Best For |

|---|---|

| Conventional Loan | Buyers with good credit and solid income |

| FHA Loan | First-time buyers with lower credit |

| VA Loan | Veterans or active military members |

| USDA Loan | Buyers in rural areas |

Also decide between a Fixed-Rate or Adjustable-Rate Mortgage (ARM).

6. Find a Home Within Budget

Stick to what you can afford — not just what you’re approved for.

Use online mortgage calculators to estimate:

- Monthly payments

- Taxes and insurance

- Long-term affordability

7. Submit a Mortgage Application

Once you find your home and make an offer, it’s time for the formal loan application.

Steps include:

- Home appraisal (to confirm value)

- Loan processing and underwriting

- Final approval

8. Close the Deal

At closing, you’ll:

- Review and sign loan documents

- Pay your down payment and closing costs

- Get the keys to your new home

The whole mortgage process usually takes 30–45 days after offer acceptance.

Conclusion

Getting a mortgage as a first-time homebuyer in the USA involves preparation, paperwork, and smart choices. Know your credit, save for a down payment, get pre-approved, and choose the right loan for your needs. With the right steps, you’ll be on your way to owning your first home smoothly.